Dd

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

(Amendment (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

Airgain, Inc.

(Name of Registrant as Specified in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required ☐ Fee paid previously with preliminary materials ☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| ||||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

Dd

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

Notice of 2022 Annual Meeting of Stockholders and Proxy Statement

Dear Stockholder:

The 20202022 annual meeting of stockholders of Airgain, Inc. will be held on Thursday,Wednesday, June 25, 2020,22, 2022, at

9:00 a.m., Pacific Time, via a live webcast for the following purposes, as more fully described in the accompanying proxy statement:

|

|

|

|

|

|

We have elected to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders by providing access to these documents on the Internet instead of mailing printed copies. Those rules allow a company to provide its stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting. Most of our stockholders will not receive printed copies of our proxy materials unless requested, but instead will receive a notice with instructions on how they may access and review our proxy materials on the Internet and how they may cast their vote via the Internet. If you would like to receive a printed or e-mail copy of our proxy materials, please follow the instructions for requesting the materials in the Notice of Internet Availability that is being sent to you.

As noted above, due to the COVID-19 pandemic for the safety of all of employees and stockholders and taking into account recent federal, state and local guidance that has been issued, our annual meeting will be a virtual meeting of stockholders, which will be conducted solely by remote communication via a live webcast. There will not be a physical meeting location and stockholders will not be able to attend the annual meeting in person. This means that you can attend the annual meeting online, vote your shares during the online meeting, and submit questions for consideration at the online meeting. To be admitted to the annual meeting'smeeting’s live webcast, you must register at www.proxydocs.com/AIRG by 5:2:00 p.m. EasternPacific Time, on Tuesday, June 23, 2020, or the Registration Deadline,20, 2022, (the "Registration Deadline") as described in the Internet notice or the proxy materials or your proxy card.materials. As part of the registration process you must enter the Control Number shown onincluded in your Internet notice, your proxy card.card or on the instructions that accompanied your proxy materials. After completion of your registration by the Registration Deadline further instructions, including a unique link to access the annual meeting, will be emailed to you.

The foregoing items of business are more fully described in the accompanying proxy statement, which forms a part of this notice and is incorporated herein by reference. Our board of directors has fixed the close of business on April 27, 2020,25, 2022, as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

Accompanying this notice

It is a proxy card.important that your shares be represented regardless of the number of shares you may hold. Whether or not you expect to attend our virtual annual meeting, please complete, sign, and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the Internet in accordance with the instructions provided on the enclosed proxy card. Ifwe urge you plan to attend our annual meeting via live webcast and wish to vote your shares personally,as soon as possible via the toll-free telephone number or over the Internet, as described in the Notice of Internet Availability and enclosed proxy materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the annual meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the annual meeting if you desire to do so, at any time before theas your proxy is voted.revocable at your option. For specific voting instructions, please refer to the information provided in the accompanying proxy statement and in the Notice of Internet Availability.

All stockholders are cordially invited to attend the meeting via a live webcast. We appreciate your continued support of the Company.

|

| By Order of the Board of Directors, |

|

|

|

|

| /s/ James K. Sims |

|

| James K. Sims |

|

|

|

San Diego, California | ||

May 2, 2022 |

San Diego, California

April 29, 2020

Your vote is important. Please vote your shares whether or not you plan to attend the meeting.

Table of Contents

3 | |

11 | |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 21 |

Proposal 3: Advisory Vote on the Compensation Paid to Our Named Executive Officers | 24 |

Proposal 4: Frequency of Advisory Vote on the Compensation Paid to Our Named Executive Officers | 24 |

Security Ownership of Certain Beneficial Owners and Management | 25 |

27 | |

38 | |

38 | |

39 | |

31 |

| ||

| ||

| ||

|

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

i

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

PROXY STATEMENT FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 25, 2020Proxy Statement for the 2022 Annual Meeting of Stockholders to Be Held on Wednesday, June 22, 2022

The board of directors of Airgain, Inc. (the "Board") is soliciting the enclosed proxy for use at the annual meetingAnnual Meeting of stockholdersStockholders to be held on Thursday,Wednesday, June 25, 2020,22, 2022, at 9:00 a.m., Pacific Time.Time (the "2022 Annual Meeting"). The annual meeting2022 Annual Meeting will be a completely virtual meeting, which will be conducted via a live webcast. Prior registration to attend the annual meeting2022 Annual Meeting at www.proxydocs.com/AIRG is required by 5:2:00 p.m. Eastern, Pacific Time, on Tuesday, June 23, 2020, or the Registration Deadline.

20, 2022 (the "Registration Deadline").

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on Wednesday, June 25, 2020:

22, 2022:

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”) are available electronically at proxydocs.com/www.proxydocs.com/AIRG.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

General Information About the 2022 Annual Meeting and Voting

Why did you send me thisam I receiving these proxy statement?materials?

We sent youhave prepared these proxy materials, including this proxy statement and the enclosed proxy card because our board of directorsBoard is soliciting your proxy to vote at the 2020 annual meeting2022 Annual Meeting of stockholders. This proxy statement summarizes information related to your vote at the annual meeting.2022 Annual Meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting2022 Annual Meeting via live webcast. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign, and return the enclosed proxy card or complete and submit your proxy via phone or the Internet in accordance with the instructions provided onin the Notice of Internet Availability of Proxy Materials or, if you requested printed copies of the proxy materials by mail, complete, sign, and return the enclosed proxy card.

We intend to begin mailingNotice of Internet Availability of Proxy Materials.

As permitted by Securities and Exchange Commission ("SEC") rules, we are making this proxy statement and our 2021 Annual Report available to our stockholders electronically via the attached notice of annual meeting, and the enclosed proxy card onInternet. On or about May 22, 2020,10, 2022, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2021 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2021 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice. We encourage our stockholders to take advantage of record entitledthe availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings and reduce the cost to us associated with the printing and mailing of materials.

Printed Copies of Our Proxy Materials.

If you received printed copies of our proxy materials, then instructions regarding how you can vote atare contained on the annual meeting.proxy card included in the materials.

How can I attend the annual meeting?2022 Annual Meeting?

This year's annual meetingyear’s 2022 Annual Meeting will be accessible through the Internet via a live webcast. Prior registration to attend the annual meeting by the Registration Deadline at www.proxydocs.com/AIRG is required. We adopted a virtual format for our annual meeting in light2022 Annual Meeting considering of the on-going developments related to the COVID-19 pandemic, and governmental decrees that in-person gatherings be postponed or canceled, and in the best interests of public health and the health and safety of our stockholders, directors, and employees.

You are entitled to participate in the annual meeting2022 Annual Meeting if you were a stockholder as of the close of business on our record date of April 27, 2020,25, 2022, or hold a valid proxy for the meeting. To be admitted to the annual meeting's2022 Annual Meeting’s live webcast, you must register at www.proxydocs.com/AIRG by the Registration Deadline as described in these proxy materials. As part of the registration process you must enter the Control Number shown on your Internet Notice, your proxy card.card, or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your Control Number or otherwise vote through the bank or broker. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the annual meeting,2022 Annual Meeting, will be emailed to you.

This year'syear’s stockholders’ question and answer session will include questions submitted electronically during the annual meeting.2022 Annual Meeting. Our virtual meeting will be governed by our Rules of Conduct and Procedures that will be available on the meeting portal when activated prior to the meeting start time and for duration of the meeting. The Rules of Conduct and Procedures will address the ability of stockholders to ask questions during the meeting including rules on permissible topics and rules for how questions and comments will be recognized and disclosed to meeting participants.

Who can vote at the annual meeting?2022 Annual Meeting?

Only stockholders of record at the close of business on the record date for the 2020 annual meeting,2022 Annual Meeting, April 27, 2020,25, 2022, are entitled to vote at the annual meeting.2022 Annual Meeting. At the close of business on this record date, there were 9,696,55710,189,236 shares of our common stock outstanding. Common stock is our only class of stock entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If, on the record date, your shares were registered directly in your name with the transfer agent for our common stock, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote at the annual meeting2022 Annual Meeting if you attend online or vote by proxy. Whether or not you plan to attend the annual meeting2022 Annual Meeting online, we encourage you to vote by proxy via the Internet, by telephone, or by mail, as instructed below to ensure your vote is counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on the record date, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and this Internet Notice or these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting.2022 Annual Meeting. As a beneficial owner you have the right to direct your broker or other agent on how to vote the shares in your account. As discussed above, if you are a street name stockholder, you are invited to attend and vote your shares at the annual meeting2022 Annual Meeting online so long as you register at www.proxydocs.com/AIRG by the Registration Deadline. However, since you are not the stockholder of record, you may not vote your shares online at the annual meeting unless yoube required to request and obtain a valid proxy from your broker, bank, or other agent.

agent in order to vote your shares online at the meeting, after following all instructions provided after your successful registration.

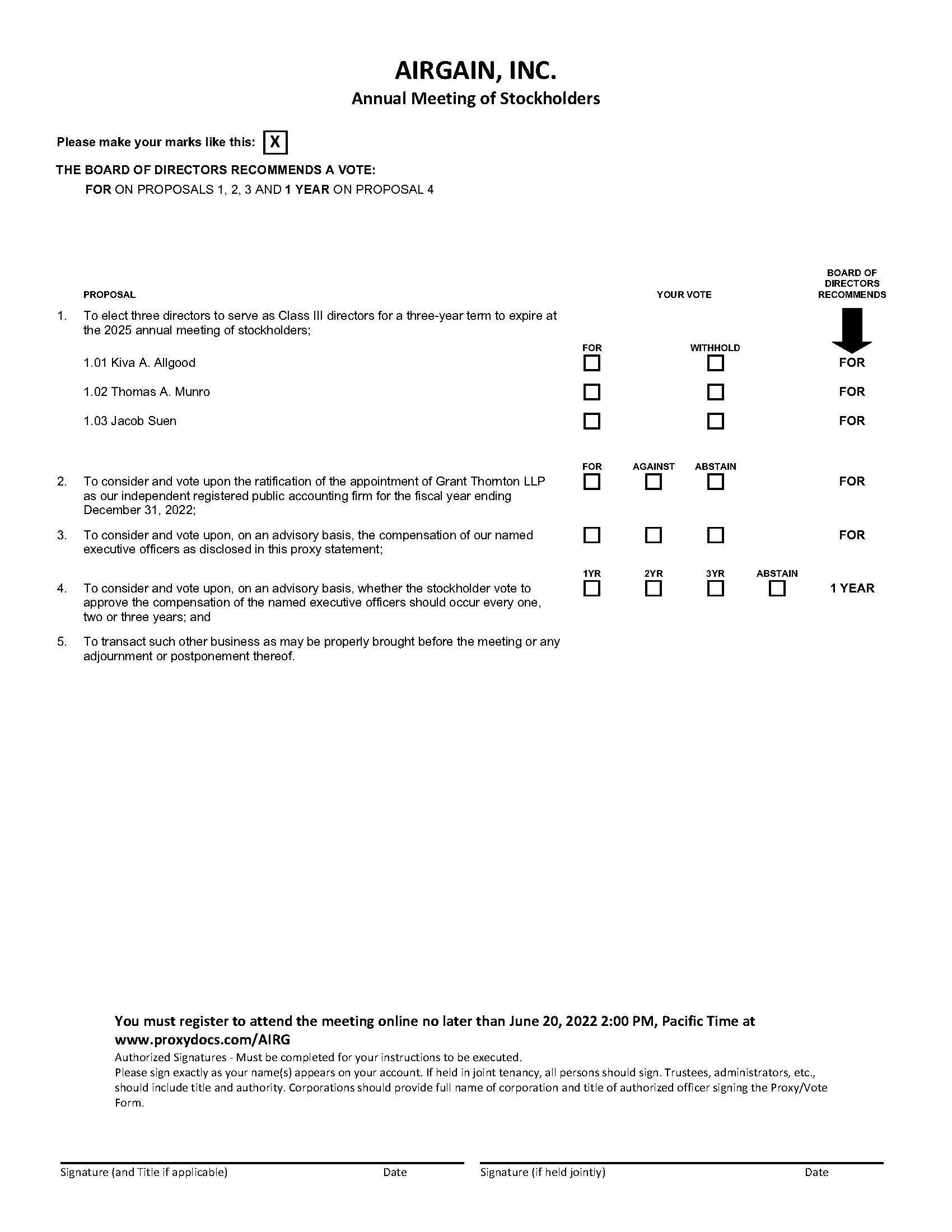

What am I voting on?

There are twofour proposals scheduled for a vote:

Proposal 1: To elect twothree directors to serve as Class IIII directors for a three-year term to expire at the 20232025 annual meeting of stockholders.

Proposal 2: To consider and vote upon the ratification of the appointment of KPMGGrant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2020.2022.

Proposal 3: To consider and vote upon, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC.

Proposal 4: To consider and vote upon, on an advisory basis, whether the stockholder vote to approve the compensation of the named executive officers as required by Section 14A(a)(2) of the Securities Exchange Act of 1934, as amended, should occur every one, two or three years.

How many votes do I have?

Each share of our common stock that you own as of April 27, 2020,25, 2022, entitles you to one vote.

How do I vote?

With respect to the election of directors, you may either vote “For” the nominees to the board of directorsBoard or you may “Withhold” your vote for any nominee to the board of directorsBoard that you specify. With respect to the ratification of the appointment of KPMGGrant Thornton LLP as our independent registered public accounting firm, you may vote “For”, “Against”“For,” “Against,” or “Abstain” from voting.With respect to the advisory vote on the compensation of our named executive officers, you may vote “For” or “Against” or abstain from voting. With respect to the advisory vote on whether the stockholder vote to approve the compensation of our named executive officers should occur every one, two or three years, you may vote for “one year,” “two years” or “three years” or abstain from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting,virtual 2022 Annual Meeting, we urge you to vote by proxy prior to the 2022 Annual Meeting to ensure that your vote is counted.

Via the Internet: You may vote at www.proxypush.com/www.proxydocs.com/AIRG,, 24 hours a day, seven days a week. Have your proxy card available when you accessweek by following the website andinstructions provided in the Internet Notice. You will need to use the Control Number shown onincluded in your Internet Notice, your proxy card.card or on the instructions that accompanied your proxy materials to vote via the Internet. Votes submitted by the Internet must be received by 8:59 a.m., Pacific Time, on June 22, 2022.

By Telephone: You may vote using a touch-tone telephone by calling (866) 829-5171, 24 hours a day, seven days a week. Have your proxy card available when you call andYou will need to use the Control Number shownincluded in your Internet Notice, your proxy card or on the instructions that accompanied your proxy materials to vote by telephone. Votes submitted by telephone must be received by 8:59 a.m., Pacific Time, on June 22, 2022.

At the Meeting: You may vote during the virtual annual meeting2022 Annual Meeting through www.proxydocs.com/AIRG. To be admitted to the annual meeting2022 Annual Meeting and vote your shares, you must register to attend the annual meeting2022 Annual Meeting at www.proxydocs.com/AIRG by the Registration Deadline, at 5:2:00 p.m. Eastern, Pacific Time on Tuesday, June 23, 2020,20, 2022, and provide the Control Number shown onincluded in your Internet Notice, your proxy card,. or on the instructions that accompanied your proxy materials. After completion of your registration, by the Registration Deadline, further instructions, including a unique link to access the annual meeting,2022 Annual Meeting, will be emailed to you.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank, or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Please check with your bank, broker, or other agent and follow the voting instructions they provide to vote your shares. Generally, you have three options for returning your proxy.

By Method Listed on Voting Instruction Card: Please refer to your voting instruction card or other information provided by your broker, bank, or other agent to determine whether you may vote by telephone or electronically on the Internet and follow the instructions on the voting instruction card or other information provided by your broker, bank, or other agent. A large number ofMany banks and brokerage firms offer Internet and telephone voting. If your bank, broker, or other agent does not offer Internet or telephone voting information, please follow the other voting instructions they provide to vote your shares.

By Mail: You may vote by signing, dating, and returning your voting instruction card in the pre-addressed envelope provided by your broker, bank, or other agent.

At the Virtual Annual Meeting: To vote online during the virtual annual meeting,2022 Annual Meeting, you mustmay be required to obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker, bank, or other agent included with these proxy materials or contact your broker, bank, or other agent to request the proxy form authorizing you to vote the shares. You must register to attend the annual meeting2022 Annual Meeting at www.proxydocs.com/AIRG by the Registration Deadline and provide the Control Number shown onincluded in your Internet Notice, your proxy card.card, or on the instructions that accompanied your proxy materials. After completion of your registration, by the Registration Deadline, further instructions, including a unique link to access the annual meeting,2022 Annual Meeting, will be emailed to you.

May I revoke my proxy?

If you give us your proxy you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the three following ways:

youYou may send in another signed proxy with a later date,

youYou may authorize a proxy again on a later date on the Internet (only the latest Internet proxy submitted prior to the annual meeting2022 Annual Meeting will be counted),

youYou may notify our corporate secretary David B. Lyle, in writing before the annual meeting2022 Annual Meeting that you have revoked your proxy, after which notification you are entitled to submit a new proxy or, so long as you register prior to the Registration Deadline,in advance, vote at the meeting, or

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote virtually at the Annual Meeting by obtaining a legal proxy from your bank or broker and submitting the legal proxy along with your ballot at the Annual Meeting.

What constitutes a quorum?

The presence at the annual meeting,2022 Annual Meeting, whether by attendance or by proxy, of holders representing a majority of our outstanding common stock as of April 27, 2020,25, 2022, or 4,848,2795,094,619 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election of Directors. The twothree nominees who receive the most “For” votes (among votes properly cast at the annual meeting2022 Annual Meeting or by proxy) will be elected. Only votes “For” will affect the outcome.

Proposal 2: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of KPMGGrant Thornton LLP must receive “For” votes from the holders of a majority in voting power of the votes cast affirmatively or negatively on the proposal. Only votes “For” or “Against” will affect the outcome.

Proposal 3: Approval of the Compensation of the Named Executive Officers. The approval of the compensation of the named executive officers must receive “For” votes from a majority of the voting power of the votes cast affirmatively or negatively on the proposal. Only votes “For” or “Against” will affect the outcome.

Proposal 4: Frequency of Stockholder Vote on Executive Compensation. The alternative which receives the most votes (among votes properly cast at the annual meeting or by proxy) will be the stockholders’ recommendation, on an advisory basis, of the frequency of the stockholder vote on executive compensation.

Voting results will be tabulated and certified by the inspector of election appointed for the annual meeting.

2022 Annual Meeting.

How will my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, then your shares will be voted at the annual meeting2022 Annual Meeting in accordance with the Board’s recommendation on all matters presented for a vote at the annual meeting.2022 Annual Meeting. Similarly, if you sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for all of the proposals, then for any proposal for which you do not so indicate, your shares will be voted in accordance with the Board’s recommendation.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

What is the effect of withheld votes, abstentions, and broker non-votes?

Shares of common stock held by persons attending the virtual annual meeting2022 Annual Meeting but not voting and shares represented by proxies that reflect withheld votes or abstentions as to a particular proposal will be counted as present for purposes of determining the presence of a quorum. Abstentions are not an affirmative or negative vote on a proposal, so abstaining does not count as a vote cast and has no effect for purposes of determining whether our stockholders have ratified the appointment of KPMGGrant Thornton LLP, our independent registered public accounting firm. or whether our stockholders have approved the compensation of the named executive officers. The election of directors isand advisory vote on the frequency of the stockholder vote on executive compensation are determined by a plurality of votes cast, so a “Withhold” vote will not be counted in determining the outcome of such proposal.proposals.

Shares represented by proxies that reflect a “broker non-vote” will be counted as present for purposes of determining the presence of a quorum exists. As discussed above, a “broker non-vote” occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. With regard to the election of directors, the advisory vote to approve the compensation of the named executive officers and the advisory vote regarding the frequency of the stockholder vote to approve the compensation of the named executive officers, which isare considered a non-routine matter,matters, broker non-votes if any, will not be counted as votes cast and will have no effect on the result of the vote. However, ratification of the appointment of KPMGGrant Thornton LLP is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

How does the Board recommend that I vote?

The Board recommends that you vote:

“For” each of the nominees for election as directors; anddirector;

“For” the ratification of the appointment of KPMGGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020.2022;

If you vote via the Internet, by telephone, or sign and return the proxy card by mail but do not make specific choices, your shares, as permitted, will be voted as recommended by our board of directors.Board. If any other matter is presented at the annual meeting,2022 Annual Meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proxy statement we know of no matters that neededneed to be acted on at the annual meeting,2022 Annual Meeting, other than those discussed in this proxy statement.

Who is paying the costs of soliciting these proxies?

We will pay all costs of soliciting these proxies. Our directors, officers, and other employees may solicit proxies in person or by mail, telephone, fax, or email. We will not pay our directors, officers, and other employees any additional compensation for these services. We will ask banks, brokers, and other institutions, nominees, and

fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Our costs for forwarding proxy materials will not be significant.

We intend to file a proxy statement and WHITE proxy card with the SEC in connection with its solicitation of proxies for our 2023 annual meeting. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at: www.sec.gov.

How do I obtain ana 2021 Annual Report on Form 10-K?Report?

If you would like a copy of our 2021 Annual Report on Form 10-K for the year ended December 31, 2019, that we filed with the Securities and Exchange Commission, or the SEC on February 28, 2020,March 21, 2022, we will send you one without charge. Please write to:

Airgain, Inc.

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

Attn: Corporate Secretary

All of our SEC filings are also available free of charge in the “Investors—SEC Filings” section of our website at www.airgain.com.

www.airgain.com.

How can I find out the results of the voting at the annual meeting?2022 Annual Meeting?

Preliminary voting results will be announced at the annual meeting.2022 Annual Meeting. Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the annual meeting.2022 Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

ELECTION OF DIRECTORS

Proposal 1: Election of Directors

Our board of directorsBoard is divided into three classes, with one class of our directors standing for election each year, generally for a three-year term. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires and hold office until the third annual meeting following election and until such director’s successor is elected and qualified, or until such director’s earlier death, resignation, or removal. As detailed in the section below, the current composition of our board of directorsBoard is as follows: Class I consists of Tzau-Jin Chung and James K. Sims; Class II consists of Joan H. Gillman and Arthur M. Toscanini; and Class III consists of Kiva A. Allgood, Thomas A. Munro, and Jacob Suen.

At this meeting twothree nominees for director are to be elected as Class IIII directors for a three-year term expiring at our 20232025 annual meeting of stockholders and until their successors are duly elected and qualified. The nominees, who were recommended for nomination by the nominating and corporate governance committee of our board of directors,Board, are Tzau-Jin ChungKiva A. Allgood, Thomas A. Munro, and James K. Sims.Jacob Suen. The Class II directors have two years remaining on their term of office and the Class I directors have one year remaining on their termsterm of office and the Class III directors have two years remaining on their terms of office.

If no contrary indication is made, proxies in the accompanying form are to be voted for Mr. ChungSuen, Ms. Allgood, and Mr. SimsMunro, or in the event that Mr. ChungSuen, Ms. Allgood, or Mr. SimsMunro is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our board of directorsBoard to fill the vacancy. Each of Mr. ChungSuen, Ms. Allgood, and Mr. SimsMunro is currently a member of our board of directors.

Board.

All of our directors bring to the board of directorsBoard significant leadership experience derived from their professional experience and service as executives or board members of other corporations and/or private equity and venture capital firms. The process undertaken by the nominating and corporate governance committee in recommending qualified director candidates is described below under “Director“Board Diversity and Director Nomination Process.” Certain individual qualifications and skills of our directors that contribute to the board of directors’Board's effectiveness as a whole are described in the following paragraphs.

Information Regarding Directors

The information set forth below as to the directors and nominees for director has been furnished to us by the directors and nominees for director:

Nominees for Election to the Board of Directors

For a three-year term expiring at the | ||||

Name | Age | Present position with Airgain, Inc. | ||

Jacob Suen | 48 | Director, President and Chief Executive Officer | ||

Kiva A. Allgood | 49 | Director | ||

Thomas A. Munro | 65 | Director | ||

Jacob Suen has served on our Board and as Chief Executive Officer, since August 2019 and as our President since January 2019. He previously served as our Senior Vice President, Worldwide Sales from May 2017 through January 2019. Mr. Suen started with the Company in April 2006 as the Vice President of Asia Pacific Sales. He previously served as the Director of Business Development from 1998 to 2005 at Paradyne Corporation. Prior to Paradyne, Mr. Suen was a development engineer at GVN Technologies in 1998. From 1997 to 1998 Mr. Suen was a software development engineer for Motorola, Inc. Mr. Suen holds an MS in Electrical Engineering with a concentration in Communication Systems and a minor in Engineering Management from the University of South Florida. Mr. Suen received an MBA with a focus on International Business and Entrepreneurship from the University of Colorado.

Mr. Suen’s extensive technical background in communication, product knowledge, extensive experience in the industries we operate and experience at our business contributed to our Board's conclusion that he should serve as a director of our Company.

Kiva A. Allgood has served on our Board since July 2021. Ms. Allgood most recently served as Global Head of IoT and Automotive for Ericsson, a global provider of communications technology. Prior, she served as Chief Commercial Development Officer, GE Business Innovations and as Managing Director, GE Ventures for GE Ventures and Business Innovation, a corporate venture company and innovation group of General Electric Company (NYSE: GE). Ms. Allgood also served as President, Qualcomm Intelligent Solutions and Vice President, New Business Development for Qualcomm Incorporated, a global provider of foundational technologies and products used in mobile devices and other wireless products. Ms. Allgood currently serves on the board of Synaptics Incorporated. Ms. Allgood has an MBA from the Kellogg School of Management at Northwestern University and a BS from Northwestern University.

Ms. Allgood’s extensive experience as an operating executive in the communications technology industries contributed to our Board's conclusion that she should serve as a director of our Company.

Thomas A. Munro has served on our Board since 2004. Mr. Munro was the Chief Executive Officer of Verimatrix, Inc., an internet security technology company, a position he held from April 2005 to March 2019. Prior to Verimatrix Mr. Munro was the President of Wireless Facilities, Inc. from 2001 to 2003 and Chief Financial Officer from 1997 to 2001. Previously he was the Chief Financial Officer of Precision Digital Images from 1994 to 1995, and Chief Financial Officer of MetLife Capital Corporation from 1992 to 1994. Mr. Munro currently serves on the board of directors of private companies BandwidthX, Inc. and Shadowbox Inc. and previously served on the boards of directors of private companies Kineticom, Inc. and CommNexus. Mr. Munro holds a BA in business and an MBA from the University of Washington.

Mr. Munro’s extensive knowledge of our business and history and experience in the wireless technology industry contributed to our Board's conclusion that he should serve as a director of our Company.

Term expiring at the | |||||||

2023 Annual Meeting of Stockholders (Class I) | |||||||

|

|

|

| ||||

Name | Age |

| Present position with Airgain, Inc. | ||||

James K. Sims |

|

|

|

|

| ||

Tzau-Jin (TJ) Chung |

|

|

|

| Director | ||

James K. Simshas served as our chairmanChair of the board of directorsBoard since November 2003. He served as our Chief Executive Officer from March 2019 to August 2019, and as our interim Chief Executive Officer from May 2018 to March 2019, and as our Executive ChairmanChair from October 2018 to March 2019. Mr. Sims has served as the ChairmanChair and Chief Executive Officer of GEN3 Partners, a consulting company that specializes in science-based technology development, since 1999, and as Managing Partner of its affiliated private equity investment fund, GEN3 Capital, LLP, since 2005. In 2017 Mr. Sims was the founding partner of Silicon Valley Data Capital. Mr. Sims founded Silicon Valley Data Science in 2012 where he is currently the Chairman. Mr. Sims also founded Cambridge Technology Partners in 1991, where he held the position of Chief Executive Officer. Prior to Cambridge Technology Partners, Mr. Sims also founded Concurrent Computer Corporation. Mr. Sims currently serves on the board of directors of various private companies including EPAY Systems, Inc., where he is currently the Chairman of the board,Board, Connections 365, Inc., and Bright Volt, Inc. He has previously served on the boardsboard of directors of public companies including Cambridge Technology Partners, Electronic Data Systems Corporation, and RSA Security, Inc., where he was the Chairman, and Electronic Data Systems Corporation. Chair.

Mr. Sims’ extensive experience as a director of numerousseveral public and private companies, as well as his extensive experience as a founder and venture capital investor in the technology industry, contributed to our board of directors’Board's conclusion that he should serve as a director of our company.Company.

TJ Chung has served on our board of directorsBoard since October 2018. Mr. Chung is currently a Senior Partner at Core Industrial Partners LLC, a private equity firm investing in North American lower middle-market industrial and

manufacturing businesses, a position he has held since July 2017. From January 2013 until his retirement in May 2016, Mr. Chung served as Chief Executive Officer of Teletrac Navman, a leading global SaasSoftware as a Service provider of commercial telematics solutions. From July 2007 to December 2012, Mr. Chung was Chief Executive Officer of Navman Wireless. Previously Mr. Chung served as President of the New Technologies Division of Brunswick Corporation from 2002 to 2007. Prior to that he served as Chief Strategy Officer of Brunswick Corporation and Senior Vice President of Brunswick Corporation’s Mercury Marine Division. Before joining Brunswick Corporation Mr. Chung was an executive at Emerson Electric. Mr. Chung currently serves on the boards of directors of Littelfuse, Inc. and MCBC Holdings, Inc. Mr. Chung earned his BS in science, electrical and computer engineering from the University of Texas at Austin. He also holds an MS in computer science from North Carolina State University and an MBA from the Fuqua School of Business at Duke University.

Mr. Chung’s extensive experience as an operating executive in the telecommunication, wireless, and technology industries contributed to our board of directors'Board's conclusion that he should serve as a director of our company.Company.

Members of the Board of Directors Continuing in Office

Term expiring at the | |||||||

| |||||||

|

|

|

| ||||

Name | Age |

| Present position with Airgain, Inc. | ||||

Joan H. Gillman |

|

|

|

| Director | ||

Arthur M. Toscanini |

|

|

|

| Director | ||

Joan H. Gillmanhas served on our board of directorsBoard since November 2016. Ms. Gillman has served as Executive Vice President and Chief Operating Officer of Time Warner Cable Media from September 2006 to June 2016. She first joined Time Warner Cable as a new product and marketing consultant in January 2004 and served from May 2005 to September 2006 as Vice President of Interactive TV and Advanced Advertising. Prior to Time Warner Cable Ms. Gillman served in senior executive roles at OpenTV Corporation, British Interactive Broadcasting Holdings Limited, and Physicians’ Online Inc. She has also held two of the top senior roles in the Officeoffice of then U.S. Senator Chris Dodd—State Director and Legislative Director. Ms. Gillman currently serves on the board of directors

of Centrica PLC, InterDigital, Inc., Cumulus Media Inc., and The Jesuit Volunteer Corp. She has previously served on the boards of directors of various private companies, industry associations, and not-for-profits;not-for-profits, including the College of the Holy Cross, the CityParks Foundation, National Cable Communications LLC, and the Interactive Advertising Bureau.

Ms. Gillman’s extensive experience as an operating executive in the cable and technology industries, as well as her service as a director of numerousseveral public and private companies, contributed to our board of directors'Board's conclusion that she should serve as a director of our company.Company.

Arthur M. Toscaninihas served on our board of directorsBoard since 2005. Mr. Toscanini is the Chief Financial Officer of GEN3 Partners, a position he has held since 2000. Prior to GEN3 Partners he was Chief Financial Officer with Cambridge Technology Partners from 1991 to 2000 where he served as the Chief Financial Officer.2000. Mr. Toscanini also served as Vice President and Controller of Concurrent Computer Corporation from 1986 to 1991. Prior to Concurrent Computer Corporation, he worked at Perkin-Elmer Data Systems Group. Mr. Toscanini currently serves on the board of directors of EPAY Systems. He holds a BA in accounting from Pace University and an MA in management from Monmouth University.

Mr. Toscanini’s extensive knowledge of our business and experience as a chief financial officer contributed to our board of directors’Board's conclusion that he should serve as a director of our company.Company.

| ||||||

| ||||||

|

|

| ||||

|

|

| ||||

|

|

| ||||

Thomas A. Munro has served on our board of directors since 2004. Mr. Munro is the Chief Executive Officer of Verimatrix, Inc., an internet security technology company, a position he has held since April 2005. Prior to Verimatrix Mr. Munro was the President of Wireless Facilities from 2001 to 2003 and Chief Financial Officer from 1997 to 2001. Previously he was the Chief Financial Officer of Precision Digital Images from 1994 to 1995 and MetLife Capital Corporation from 1992 to 1994. Mr. Munro currently serves on the board of directors of BandwidthX, Inc., a private company, and previously served on the boards of directors of private companies Kineticom, Inc. and CommNexus. Mr. Munro holds a BA in business and an MBA from the University of Washington. Mr. Munro’s extensive knowledge of our business and history and experience in the wireless technology industry contributed to our board of directors’ conclusion that he should serve as a director of our company.

Jacob Suen has served on our board of directors and as Chief Executive Officer since August 2019 and as our President since January 2019. He previously served as our Senior Vice President, Worldwide Sales from May 2017 through January 2019. Mr. Suen started with the company in April 2006 as the Vice President of Asia Pacific Sales. He previously served as the Director of Business Development from 1998 to 2005 at Paradyne Corporation. Prior to Paradyne Mr. Suen was a development engineer at GVN Technologies in 1998. From 1997 to 1998 Mr. Suen was a software development engineer for Motorola Incorporation. Mr. Suen holds an MS in Electrical Engineering with a concentration in Communication Systems and a minor in Engineering Management from the University of South Florida. Mr. Suen has his MBA with a focus on International Business and Entrepreneurship from the University of Colorado. Mr. Suen’s extensive knowledge of and experience at our business contributed to our board of directors’ conclusion that he should serve as a director of our company.

Board Independence

Our board of directorsBoard currently consists of sixseven members. Our board of directorsBoard has determined that all of our directors are independent directors within the meaning of the applicable Nasdaq Stock Market LLC, or Nasdaq, listing standards, except for Mr. Sims, our chairman of the board of directorsChair, and Mr. Suen, our President and Chief Executive Officer and President.Officer. The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our board of directorsBoard has made a

subjective determination as to each independent director that no relationships exist which, in the opinion of our board of directors,Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations our board of directorsBoard reviewed and discussed information provided by the directors and us with regard to each director’s business and

personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

Board Leadership Structure

Our board of directorsBoard is currently led by its chairman,Chair, James K. Sims. Our board of directorsBoard recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the companyCompany continues to grow.

In May 2018 Mr. Sims was appointed as our interim Chief Executive Officer and continued to serve as the chairman of our board of directors. From March through August 2019, Mr. Sims was appointed and served as our permanent Chief Executive Officer. The board of directors believed that Mr. Sims’ service as both chairman of the board of directors and Chief Executive Officer was in the best interest of the company and its stockholders at the time. On August 8, 2019, the board of directors appointed Jacob Suen, as our Chief Executive Officer and a member of our board of directors in addition to his role as President.

Pursuant to our Corporate Governance Guidelines the boardBoard determines the best board leadership structure for our companyCompany from time to time. As part of our annual board self-evaluation process, we evaluate our leadership structure to ensure that the board continues to believe that it provides the optimal structure for our companyCompany and stockholders. We recognize that different board leadership structures may be appropriate for companies in different situations. We believe our current leadership structure is the optimal structure for our companyCompany at this time.

Each of the directors, other than Messrs. Sims and Suen, is independent, and the boardBoard believes that the independent directors provide effective oversight of management. Moreover, in addition to feedback provided during the course of boardBoard meetings, the independent directors have regular executive sessions. Following an executive session of independent directors, the independent directors communicate with Mr. Suen directly regarding any specific feedback or issues, provide Mr. Suen with input regarding agenda items for boardBoard and boardBoard committee meetings, and coordinate with Mr. Suen regarding information to be provided to the independent directors in performing their duties. The boardBoard believes that this approach appropriately and effectively complements the combined Chief Executive Officer/Director structure.

Role of Board in Risk Oversight Process

Our board of directorsBoard has responsibility for the oversight of the company’sCompany’s risk management processes and—and, either as a whole or through its committees—committees, regularly discusses with management our major risk exposures, their potential impact on our business, and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board of directorsBoard to understand the company’sCompany’s risk identification, risk management, and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

The audit committee reviews information regarding liquidity and operations and oversees our management of financial risks. Periodically the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention, and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor, or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directorsBoard is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board of directorsBoard as a whole.

Board of Directors Meetings

During 20192021 our board of directorsBoard met seveneight times, including telephonic meetings. In that year2021 each director attended at least 75% of the total number of meetings held during such director’s term of service by the board of directorsBoard and with the exception of Ms. Gillman on the Nomination and Corporate Governance Committee, each committee of the board of directorsBoard on which such director served.

Board Committees and Independence

Our board of directorsBoard has established three standing committees—audit, compensation, and nominating and corporate governance—each operating under a charter that has been approved by our board of directors.Board. The table below provides current committee membership information for each of the Board committees.

|

| Committees | ||||

Name |

| Audit |

| Compensation |

| Nomination and Corporate Governance |

Tzau-Jin Chung |

| X |

|

|

|

|

Joan H. Gillman |

| X |

|

|

| Chair |

Thomas A. Munro |

|

|

| Chair |

| X |

Arthur M. Toscanini |

| Chair |

| X |

|

|

Number of committee meetings held in 2019 |

| 4 |

| 2 |

| 3 |

| Committees | ||

Name | Audit | Compensation | Nominating and Corporate Governance |

Kiva A. Allgood |

|

| X |

Tzau-Jin Chung | X |

|

|

Joan H. Gillman | X |

| Chair |

Thomas A. Munro |

| Chair | X |

Arthur M. Toscanini | Chair | X |

|

Number of committee meetings held in 2021 | 4 | 4 | 2 |

Audit Committee

The audit committee’s main function is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committee’s responsibilities include, among other things:

appointing our independent registered public accounting firm;

evaluating the qualifications, independence, and performance of our independent registered public accounting firm;

approving the audit and non-audit services to be performed by our independent registered public accounting firm;

reviewing the design, implementation, adequacy, and effectiveness of our internal accounting controls and our critical accounting policies;

discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements;

reviewing, overseeing, and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

reviewing on a periodic basis—or as appropriate—any investment policy and recommending to our board of directorsBoard any changes to such investment policy;

reviewing any earnings announcements and other public announcements regarding our results of operations;

preparing the report that the SEC requires in our annual proxy statement;

reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics; and

reviewing and evaluating—at least annually—the performance of the audit committee and its members including compliance of the audit committee with its charter.

Our board of directorsBoard has determined that all of the members of the audit committee are independent directors under the applicable rules and regulations of Nasdaq and by Rule 10A-3 of Securities and Exchange Act of 1934, as amended, or the Exchange Act. In addition, all members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq. Our board of directorsBoard has determined that Mr. Toscanini is an “audit committee financial expert” as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq rules and regulations. Both our external auditor and internal financial personnel meet privately with the audit committee and have unrestricted access to this committee. The

audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq, which the audit committee will review and evaluate at least annually.

Compensation Committee

The compensation committee approves or recommends to our board of directors,Board, policies and programs relating to compensation and benefits of our officers and employees. The compensation committee (a) approves or recommends to our board of directors,Board annual corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other

executive officers, (b) evaluates the performance of these officers in light ofrelative to those goals and objectives, and (c) approves or recommends to our board of directors,Board the compensation of these officers, based on such evaluations. The compensation committee alsoand (d) approves or recommends to our board of directors,Board the issuance of stock options and otherequity awards under our equity plan.

Our board of directorsBoard has determined that all members of the compensation committee are independent under the applicable rules and regulations of Nasdaq relating to compensation committee independence.independence and “non-employee directors” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended. The compensation committee operates under a written charter which the compensation committee will review and evaluate at least annually.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for assisting our board of directorsBoard in discharging the board’sits responsibilities regarding the identification of qualified candidates to become board members of our Board, the selection of nominees for election as directors at our annual meetingsmeeting of stockholders (or special meetingsmeeting of stockholders at which directors are to be elected), and the selection of candidates to fill any vacancies on our board of directorsBoard and any committees thereof. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies, as well as, reporting and making recommendations to our board of directorsBoard concerning governance matters and oversight of the evaluation of our board of directors.

Board, and concerning environmental, social, and governance (ESG) matters and initiatives.

Our board of directorsBoard has determined that all members of the nominating and corporate governance committee are independent under the applicable rules and regulations of Nasdaq. The nominating and corporate governance committee operates under a written charter which the nominating and corporate governance committee will review and evaluate at least annually.

Audit Committee Report

The audit committee oversees the company’s financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities the audit committee reviewed the audited financial statements in the company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements, and the effect of any new accounting initiatives.

The audit committee reviewed with KPMG LLP, who is responsible for expressing an opinion on the conformity of the company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the company’s accounting principles, and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards and the matters listed in Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees. In addition the audit committee has discussed with KPMG LLP, its independence from management and the company, has received from KPMG LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communications with the audit committee concerning independence and has considered the compatibility of non-audit services with the auditors’ independence.

The audit committee met with KPMG LLP to discuss the overall scope of its services, the results of its audit and reviews, and the overall quality of the company’s financial reporting. KPMG LLP, as the company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the company’s reporting. The audit committee’s meetings with KPMG LLP were held with and without management present. The audit committee is not employed by the company, nor does it provide any expert assurance or professional certification regarding the company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the company’s board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2019.

The audit committee and the company’s board of directors have recommended, subject to stockholder approval, the ratification of the appointment of KPMG LLP as the company’s independent registered public accounting firm for 2020.

This report of the audit committee is not “soliciting material,” shall not be deemed “filed” with the SEC, and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

| ||

| ||

| ||

|

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee during 20192021 has ever been one of our officers or employees. None of our executive officers currently serves, or has served, as a member of the board of directorsBoard or compensation committee of any entity that has one or more executive officers serving as a member of our board of directorsBoard or compensation committee.

Board Diversity and Director Nomination Process

Director Qualifications

Our nominating and corporate governance committee is responsible for reviewing with the board of directors,Board, on an annual basis, the appropriate characteristics, skills, and experience required for the board of directorsBoard as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors,Board, in approving (and, in the case of vacancies, appointing) such candidates, will take into account manyconsider factors, including the following:

personal and professional integrity, ethics, and values;

experience in corporate management, such as serving as an officer or former officer of a publicly-held company;

•

strong finance and/or business operations experience;

diversity of expertise and experience in substantive matters pertaining to our business relative to other members of our board of directors;

diversity of background and perspective, including but not limited to, with respect to age, gender, race, place of residence, and specialized experience;

experience relevant to our businessbusiness' industry, and withincluding regarding relevant social issues and policy concerns;concerns applicable to our industry; and

relevant academic expertise or other proficiency in an area of our business operations.

Currently our board of directorsBoard evaluates each individual in the context of the board of directorsBoard as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. Four of the seven members of our current Board are either female or self-identify as members of an underrepresented community.

Other than the foregoing there are no stated minimum criteria for director nominees, although the nominating and corporate governance committee may also consider such other factors as it may deem to be in the best interests of our companyCompany and our stockholders. The nominating and corporate governance committee does, however, believe it appropriate for at least one, and preferably, several members of our board of directorsBoard to meet the criteria for an

“audit “audit committee financial expert” as defined by SEC rules, and that a majority of the members of our board of directorsBoard meet the definition of “independent director” under Nasdaq qualification standards. The nominating and corporate governance committee also believes it is appropriate for our President and Chief Executive Officer and President to serve as a member of our board of directors.Board.

The following Board Diversity Matrix presents our Board diversity statistics in accordance with Nasdaq Rule 5606, as self-disclosed by our directors:

Board Diversity Matrix (As of April 25, 2022) | ||||

Total Number of Directors | 7 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender |

Part I: Gender Identity | ||||

Directors | 2 | 5 |

|

|

Part II: Demographic Background | ||||

African American or Black |

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

Asian |

| 2 |

|

|

Hispanic or Latinx |

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White | 2 | 3 |

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ+ |

| |||

Did Not Disclose Demographic Background |

| |||

Identification and Evaluation of Nominees for Directors

The nominating and corporate governance committee identifies nominees for director by first evaluating the current members of our board of directorsBoard willing to continue in service. Current members with qualifications and skills that are consistent with the nominating and corporate governance committee’s criteria for board of director service and who are willing to continue in service are considered for re-nomination while, at the same time,

balancing the value of continuity of service by existing members of our board of directorsBoard with that of obtaining a new perspective or expertise.

If any member of our board of directorsBoard does not wish to continue in service, or if our board of directorsBoard decides not to re-nominate a member for re-election, or if the board of directorsBoard decides to expand the size of the board;Board, the nominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. The nominating and corporate governance committee generally polls our board of directorsBoard and members of management for their recommendations. The nominating and corporate governance committee may also review the composition and qualification of the boards of directors of our competitors and may seek input from industry experts or analysts. The nominating and corporate governance committee reviews the qualifications, experience, and background of the candidates. Final candidates are interviewed by the members of the nominating and corporate governance committee and by certain of our other independent directors and executive management. In making its determinations the nominating and corporate governance committee evaluates each individual in the context of our board of directorsBoard as a whole, with the objective of assembling a group that can best contribute to the success of our companyCompany and represent stockholder interests through the exercise of sound business judgment. After review and deliberation of all feedback and data, the nominating and corporate governance committee makes its recommendation to our board of directors. Historically the nominating and corporate governance committee has not relied on third-party search firms to identify director candidates. The nominating and corporate governance may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

Board.

The nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. We have not received director candidate recommendations from our stockholders and we do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by members of our board of directors,Board, management, or other parties are evaluated.

Under our amended and restated bylaws, a stockholder wishing to suggest a candidate for director should write to our corporate secretary and provide such information about the stockholder and the proposed candidate as is set forth in our amended and restated bylaws and as would be required by SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangementsarrangement or undertakings between the stockholder and the candidate regarding the nomination. In order to give the nominating and corporate governance committee sufficient time to evaluate a recommended candidate and include the candidate in our proxy statement for the 20212023 annual meeting, the recommendation should be received by our corporate secretary at our principal executive offices in accordance with our procedures detailed in the section below entitled “Stockholder Proposals.”

"

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directorsBoard at our annual meeting, we encourage all of our directors to attend. No memberAll members of our board of directorsBoard at the time virtually attended our annual meeting of stockholders in 2019.

2021.

Communications with our Board of Directors

Stockholders seeking to communicate with our board of directorsBoard should submit their written comments to our corporate secretary, Airgain, Inc., 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130. The corporate

secretary will forward such communications to each member of our board of directors;Board; provided that, if in the opinion of our corporate secretary it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion).

Prohibition Against Pledging and Hedging

We maintain an Insider Trading Compliance Policy that prohibits our officers, directors, and employees pledging our stock as collateral to secure loans and from engaging in hedging transactions, including zero-cost collars and forward sale contracts. It further prohibits margin purchases of our stock, short sales of our stock, and any transactions in puts, calls, or other derivative securities involving our stock.

Corporate Governance

Our company’sCompany’s Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, and Nominating and Corporate Governance Committee Charter are available, free of charge, on our website at www.airgain.com.Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide copies of these documents as well as our company’sCompany’s other corporate governance documents, free of charge, to any stockholder upon written request to Airgain, Inc., 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130, Attention: Corporate Secretary.

Director Compensation

Our board of directorsBoard has approved a compensation policy for our non-employee directors. The non-employee director compensation policy provides for annual retainer fees and long-term equity awards for our non-employee directors. Pursuant to the terms of the non-employee director compensation policy, each non-employee director, other than the Chair, will receive an annual retainer of $32,000. During 2020, from and after February 9, 2020,In 2021, our chairmanChair of the boardBoard received an annual retainer of directors will receive a cash retainer for his service as the non-employee chairman$175,000. Commencing in 2022, our Chair of the board for the remainderBoard receives an annual retainer of 2020, based on an annualized rate of $240,000 per year. Commencing in 2021 our chairman of the board of directors will receive an additional $26,500 annual retainer.$58,500. Non-employee directors serving as the chairsChairs of the audit, compensation,Audit, Compensation, and nominatingNominating and corporate governance committeesCorporate Governance Committees will receive additional annual retainers of $16,000, $10,600, and $8,000, respectively. Non-employee directors serving as members of the audit, compensation,Audit, Compensation, and nominatingNominating and corporate governance committeesCorporate Governance Committees will receive additional annual retainers of $8,000, $5,300 and $4,000, respectively.

Each non-employee director who is newly elected or appointed to the board of directorsBoard will also receive, effective on the date of such election or appointment (or such other date specified by the board of directors)Board), (1) an initial grant of options to purchase a number of shares of our common stock having a value of $50,000, calculated as of the date of grant in accordance with the Black-Scholes option pricing model (utilizing the same assumptions that we utilize in preparation of our financial statements and the thirty-day trailing average trading price of our common stock preceding the date of grant, or the Thirty-Day Trailing Average, plus (2) such number of restricted stock units as is determined by dividing (A) $50,000 by (B) the Thirty-Day Trailing Average, which initial awards will vest in substantially equal installments on each of the first three anniversaries of the date of grant. All of a non-employeeNon-employee director’s initial awards shall vest in full immediately prior to the occurrence of a change in control, to the extent outstanding at such time.

Each non-employee director will receive an annual award on the first trading day in February of each year of (1) a number of stock options having a value of $30,000 (with the award to the chairpersonChair of the board of directorsBoard having a value of $45,000), calculated as of the date of grant in accordance with the Black-Scholes option pricing model (utilizing the same assumptions that we use in preparation of our financial statements and the Thirty-Day Trailing Average), plus (2) such number of restricted stock units as is determined by dividing (A) $30,000 (with the award to the chairpersonChair of the board of directorsBoard having a value of $45,000) by (B) the Thirty-Day Trailing Average, which annual awards will vest on the first anniversary of the date of grant. All of a non-employee director’s annual awards shall vest in full immediately prior to the occurrence of a change in control, to the extent outstanding at such time.

In addition, the non-employee director compensation policy contains an ownership guideline so thatrequiring members of the board of directors are requiredBoard to own shares with a value of at least three times the then-current annual retainer on or before September 30, 2021, or, if later,retainer. A newly appointed director is subject to this guideline within three years after the director’s first appointment to the board of directors. Board. Compensation under our compensation policy is subject to the annual limits on non-employee director compensation set forth in our 2016 Incentive Award Plan, referred to herein as the 2016 Plan. Our board of directorsBoard or its authorized committee may modify the non-employee director compensation policy from time to time in the exercise of its business judgment, taking into accountconsidering such factors circumstances and considerationscircumstances as it shall deem relevant from time to time, subject to the annual limit on non-employee director compensation set forth in the 2016 Plan. As provided in the 2016 Plan, our board of directorsBoard or its authorized committee may make exceptions to this limit for individual non-employee directors in extraordinary circumstances, as the board of directorsBoard or its authorized committee may determine in its discretion, provided that the non-employee director receiving such additional compensation may

not participate in the decision to award such compensation or in other compensation decisions involving non-employee directors.

Mr. Suen, who serves as our President and Chief Executive Officer President, and a member of our board of directorsBoard receives no additional compensation for his service as a director.